Rugalmas. Integrált. Biztonságos.

LIBRA vállalatirányítási rendszerek az operatív és adminisztratív tevékenységek, valamint a vezetői döntéshozatal támogatásához

LIBRA 3s

integrált ügyviteli rendszer kis- és középvállalkozásoknak

- Rugalmas folyamattámogató megoldás

- Teljes körű adatszolgáltatás

- Kedvező díjszabás

LIBRA 3s

integrált vállalatirányítási rendszer nagyvállalatoknak

- Átfogó vezetői kontroll

- Teljes integráltság

- 100%-os biztonság

LIBRA Online Számla

LIBRA Online Számla

- ERP vagy fájl szintű integráció

- Valós idejű, automatizált online adatszolgáltatás

TÁRJA FEL A LEHETŐSÉGEIT

Szabja cégére a LIBRA rendszereket speciális funkciókkal és kapcsolódó megoldásainkkal.

LIBRA Folyamat- menedzsment

LIBRA Folyamat- menedzsment

LIBRA Report Engine

LIBRA Virtua

Személyszállítási szoftvermegoldások

Személyszállítási szoftvermegoldások

LIBRA InfoCenter

Közüzemi szoftvermegoldások

Közüzemi szoftvermegoldások

LIBRA-EKÁER kapcsolat

LIBRA Projektkalkuláció

LIBRA Projektkalkuláció

SZAKMAI

TAPASZTALAT

a vállalatirányítási rendszer terén

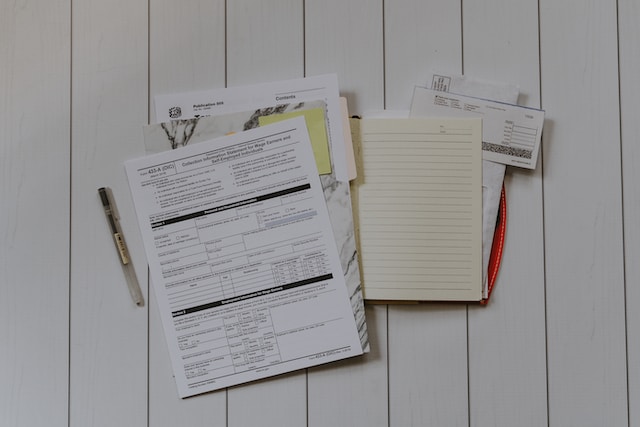

A Libra Szoftver Zrt. 2006-ban jött létre a Volán Elektronika Zrt. leányvállalataként. A LIBRA az anyavállalattól az integrált vállalatirányítási és ügyviteli szoftverek forgalmazását és utógondozását vette át, melyek a néhány fős kisvállalkozásoktól egészen a több ezer főt foglalkoztató nagyvállalatokig, a legkülönfélébb környezetben és a gazdaság minden területén, a non-profit szférában és az oktatásban is alkalmazásban vannak.

Szoftverek, amelyek együtt növekednek a céggel

A partnerségben hiszünk.

Minden adat egy helyen.

AMIT KÍNÁLUNK

Egyetlen program vagy komplex rendszer – Ön dönt!

Teljes integráltság

Nincs szükség többszörös adatbevitelre, és mivel az egyes funkciók egymásra épülnek, az adatok egy egységes vállalati adatbázisba kerülnek.

100%-os biztonság

Az adatbázis-kezelő rendszer eredendően biztosítja a tranzakciók védelmét – adatvesztés vagy programhiba miatt adatvisszatöltési igény még nem fordult elő.

Széles körű lekérdezési lehetőség

Tetszőleges listák és kimutatások készíthetők minden programból.

Rugalmas méretezhetőség

A rendszerek moduláris felépítésűek, így könnyedén az igényekhez alakíthatóak.

Gyártói támogatás

Folyamatos szoftverkövetés biztosítja, hogy a LIBRA rendszerek mindenben naprakészek legyenek.

Felhasználóbarát, egyszerű működés

Az egyedi igényeket cégre szabott fejlesztésekkel szolgáljuk ki.

AHOL KIEMELKEDŐEK VAGYUNK

Speciális iparági csoportok, ahol a LIBRA rendszerek évtizedek óta támogatják a vállalat működését.

Közműszolgáltatók

Volán társaságok

Városgazdálkodók

Erdőgazdaságok

ESETTANULMÁNYOK

Partnereink, akikkel régóta osztozunk a sikerben

CÉGÜNK

A Libra Szoftver Zrt. az elmúlt években cégcsoporttá nőtte ki magát.

AMIRE BÜSZKÉK VAGYUNK

Partnereink véleménye a LIBRA rendszerekről